The ecommerce landscape of 2026 is no longer defined by the rapid “growth-at-all-costs” mentality of the early 2020s. Instead, it is governed by a fundamental, structural shift in consumer behavior: the rise of the Value-Seeker. Research from early 2026 indicates that this is not a transient reaction to past inflation, but a permanent recalibration of the household economic playbook.

1. The Structural Shift: From Inflation Shock to Lasting “Scars”

As of February 2026, the global consumer base has reached a tipping point. Recent data shows that 47% of global consumers (and 40% of Americans) now identify as “value seekers”—individuals who intentionally sacrifice convenience for savings, trade down to private-label brands, and exhibit deal-driven habits.

Critically, nearly 70% of retail executives now agree that these behaviors represent a permanent structural change rather than a temporary response to the high inflation of 2022–2024.

The 40% Rule of Perceived Value

In this environment, price and value are no longer synonymous. Research indicates that as much as 40% of a brand’s perceived value now stems from non-price factors.

-

Customer Service Excellence: High-quality, reliable interactions.

-

Trust and Reliability: Accuracy in fulfillment and transparency in communication.

-

Ease of Checkout: Frictionless payment and loyalty integration.

-

Post-Purchase Experience: Specifically, how a brand handles the “Reverse Logistics” lifecycle.

2. The Return Crisis: Turning a Cost Center into a Retention Lever

The quest for value has led to a “Return Crisis” across the industry. As consumers become more discerning, the rate of returns has climbed, with projections for 2026 reaching between 20.4% and 24.5% for general ecommerce.

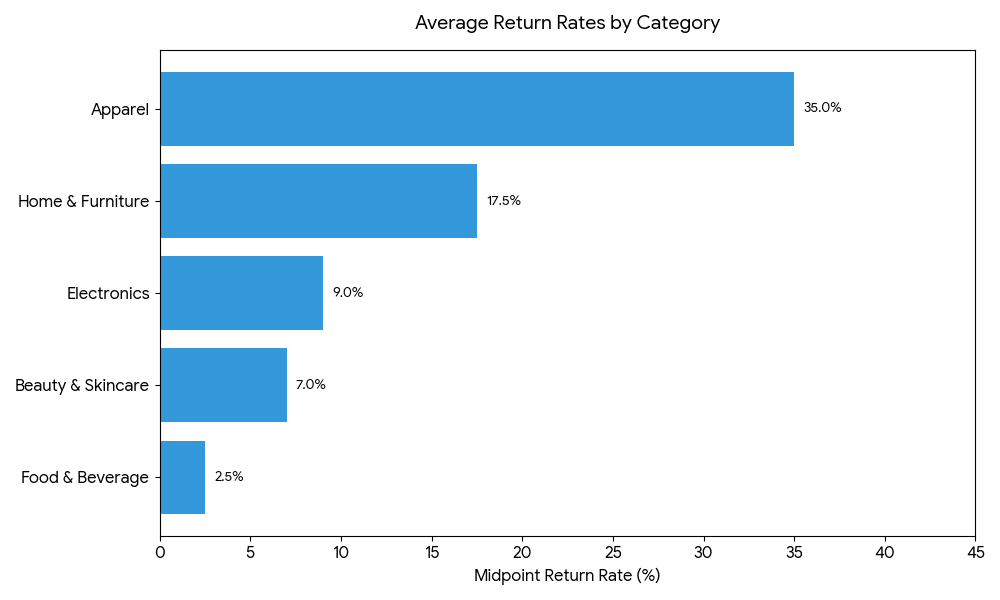

Return Rates and Drivers by Category (2025-2026)

The following table outlines the current performance benchmarks and primary drivers of returns across the major ecommerce verticals:

| Category | Average Return Rate | Key Driver of Returns |

| Apparel |

30% – 40% |

Sizing inconsistencies; “Bracketing” (buying multiple sizes) |

| Home & Furniture |

15% – 20% |

Style uncertainty; shipping/delivery damage |

| Electronics |

8% – 10% |

Technical specification comparison; price shopping |

| Beauty & Skincare |

4% – 10% |

Lower risk/AOV; high repeat purchase frequency |

| Food & Beverage | 2% – 3% | Perishability; high brand loyalty |

The Rise of Defensive Metrics: Fraud and Fees

As return volumes surge, so does the prevalence of return fraud, which now sits at a 15.1% rate across all ecommerce.

To combat these margin-eroding trends, the industry has shifted away from “universal free returns.” As of early 2026:

-

65.2% of merchants now charge return fees for mail-in returns, with an average fee of $9.04.

-

To mitigate the friction of these fees, brands are pivoting toward Bonus Credit. Over 51% of merchants now offer an average incentive of $11.28 to encourage customers to choose an exchange or store credit over a refund.

-

76% of first-time customers who experience an easy, transparent return process say they would shop with that retailer again, proving that returns are now a primary driver of Lifetime Value (LTV).

Is Your Business Ready for Professional Order Fulfillment Services?

Take our 3-minute assessment to discover if partnering with a fulfillment service could help scale your business.

Storage Solutions

Optimize your inventory management

Scale Operations

Support your business growth

Save Time

Focus on core business activities

Improve Accuracy

Enhance customer satisfaction

Takes 3 minutes • Get instant results • Free analysis

Business Metrics

Assessment Questions (1-4)

Assessment Questions (5-8)

Assessment Results

3. The Shrinkflation and Transparency Paradox

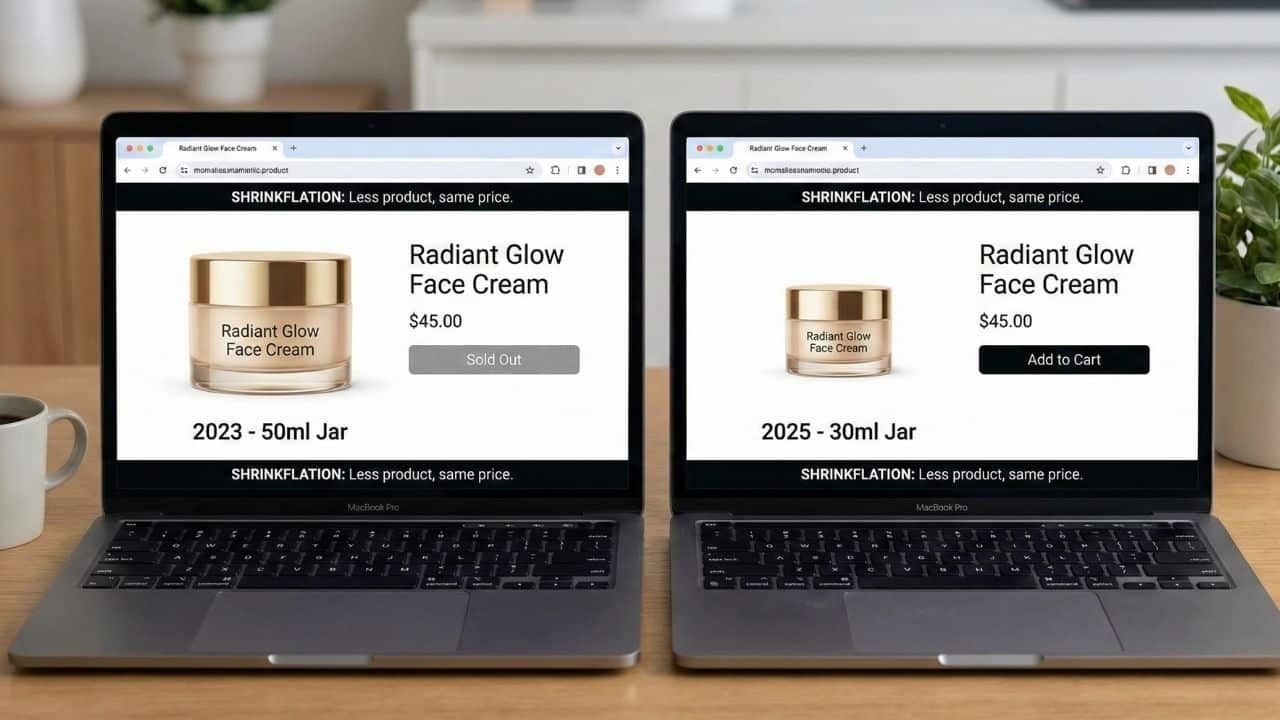

To protect margins against rising carrier costs (which are effectively increasing by 8%–12% in 2026 due to surcharges), many brands have turned to “shrinkflation“—reducing product size or quantity while maintaining prices.

However, this tactic carries immense risk in the 2026 psychology of fairness. 64% of consumers explicitly view shrinkflation as an “unfair practice,” and 71% say they would switch brands immediately if product quality or pack sizes were reduced without clear, transparent communication.

The Role of 3PLs in “Fairness” Engineering

This transparency requirement intersects directly with 3PL operations. Changes in packaging are often necessary to meet the EU’s Packaging and Packaging Waste Regulation (PPWR), which mandates a 50% maximum empty space limit starting in August 2026.

-

Strategic Opportunity: Brands must frame these changes as “sustainability wins” or “efficiency improvements” rather than cost-cutting.

-

Operational Execution: High-performing 3PLs are helping brands combat the perception of “paying for air” by implementing fit-to-size packaging and automated “right-sizing” of boxes, which can reduce logistics costs by an average of 9%.

Fulfillment with a Personal Touch.

See How Using a 3PL like eFulfillment Service sellers saves time. Get a Free Quote from eFulfillment Service Today!

4. AI-Driven Fairness vs. The Human Requirement

Technology in 2026 is being leveraged to build “fairness” into the value proposition. AI is no longer just for product recommendations; it is being used for:

-

Dynamic Inventory Rebalancing: Moving stock between locations before problems grow to avoid stockouts for value-seeking shoppers.

-

Predictive Replenishment: Improving inventory turnover by 25% to 30% to free up working capital.

-

Personalized Loyalty Pricing: Using AI to justify base prices by offering customized, member-only value triggers.

Despite the surge in AI, the “Human Touch” has seen a sharp resurgence in value. 74% of consumers report that they value human assistance during customer service interactions, and 66% want human support during the purchase stage, a significant increase from previous years.

Final Note

In 2026, the brands that win are those that treat shipping and fulfillment not as a variable expense, but as a core component of the Cost of Goods Sold (COGS). To succeed in the value-seeking era, sellers must:

- Prioritize Revenue Retention: Move from “refund-first” to “exchange-first” policies using incentives like Bonus Credit.

- Audit for “Air”: Work with 3PLs to eliminate void space to comply with EU regulations and avoid “Handling Taxes” from carriers.

- Bridge the AI-Human Gap: Use AI for backend efficiency (inventory velocity) but maintain human support for frontend trust (CX).

- Leverage 3PL Accuracy: Partner with providers capable of 99.95% accuracy to reduce the “silent killer” of margins: avoidable returns and customer churn.

Works cited

- 2026 Consumer Products Industry Global Outlook – Deloitte, accessed February 9, 2026, https://www.deloitte.com/us/en/insights/industry/consumer-products/consumer-products-industry-outlook.html

- 2026 Retail Industry Global Outlook | Deloitte Insights, accessed February 9, 2026, https://www.deloitte.com/us/en/insights/industry/retail-distribution/retail-distribution-industry-outlook.html

- 2026 Global Ecommerce Report: Retention Benchmarks of High-Performing Brands, accessed February 9, 2026, https://www.loopreturns.com/reports/retention-benchmarks-2026/

- Consumer Outlook: Guide to 2026 – NIQ, accessed February 9, 2026, https://nielseniq.com/global/en/insights/report/2025/consumer-outlook-guide-to-2026/

- What’s The Average Ecommerce Return Rate? Industry Analysis – Red Stag Fulfillment, accessed February 9, 2026, https://redstagfulfillment.com/average-return-rates-for-ecommerce/

- Ecommerce Conversion Rate by Industry: 2026 Benchmarks – Fyresite, accessed February 9, 2026, https://www.fyresite.com/ecommerce-conversion-rate-by-industry-benchmarks/

- 2026 UPS & FedEx Shipping Rate Hikes: Essential Survival Strategies, accessed February 9, 2026, https://www.zenventory.com/blog/blog/ups-fedex-shipping-rate-hikes-strategies

- What matters to today’s consumer 2026 – Capgemini, accessed February 9, 2026, https://www.capgemini.com/wp-content/uploads/2026/01/Final-Web-Version-Report-Consumer-Trends-2026.pdf

- E-commerce packaging regulations: what’s changing from 2026, accessed February 9, 2026, https://www.qapla.io/blog/shipping/ecommerce-packaging-regulation-2026/

Shipping Is the New COGS: Carriers’ 2026 Rate Hikes Are Squeezing Ecommerce Margins, accessed February 9, 2026, https://www.prnewswire.com/news-releases/shipping-is-the-new-cogs-carriers-2026-rate-hikes-are-squeezing-ecommerce-margins-302682570.html

0 Comments